(This is part of a series of blog posts on Mobility in 2011)

Mobility in 2011: Networks & Operators

Operators will continue their shift towards mobile data and packet services, and value add services, with a large increase on mobile network bandwidth (10X according to IDC) thanks to LTE and 3G network and updates, as well as expected growth (as in massive) consumption of such bandwidth due to the smartphones and wireless modems and mobile apps, including real-time video services.

Mobile apps and data usage will be (a new) major pain-point for operators who will be looking for new application awareness methods to help them deal with the issues related to apps, across multiple mobile platforms, and the related services on the cloud, and last but not least, higher expectations from consumers. Recall that just a month ago (Jan 2011) Apple announced its 10Billion app download; very impressive. Yes, apps and data are the operator’s “new SMS”; as in cash cow.

According to Strategy Analytics, the expected Global CAPEX for service providers is in the $Billions: $270B in 2010 –> $310B in 2015; that is a 5 Yr CAGR of 2.8% (IDC); that is massive investment.

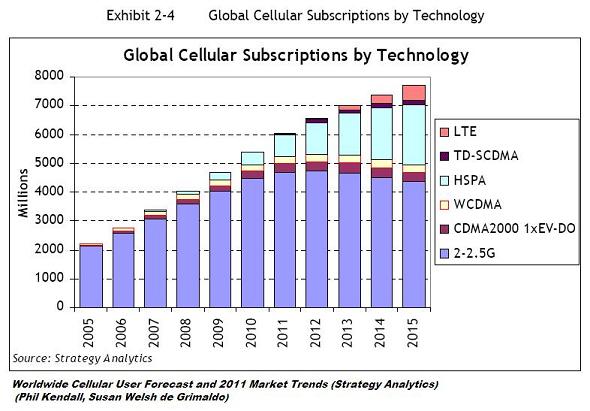

The expected growth of cellular subscription will continue its exponential growth; the following chart shows the global cellular subscriptions by technology (Strategy Analytics).

3G UMTS (and related upgrades such as HSPA+) and EVDO, will continue to persists as the dominant network bearers while LTE gets fully deployed; we are probably talking 3-5 years. Not shown above is the fact that WiFi now accounts for more than 50% of mobile user connections to the Internet, according to a new study from Bango (Feb 2011).

Operators will and should continue catering developers. Many will and are expanding their developer programs with the goal of expanding their own developer communities, via new APIs into operator-services and revenue sharing offerings. But to succeed, operators must really invest on such programs; it is not only about offering a developer website and some APIs, but it is a continuous exercise from enabling the developers but also offering go-to-market benefits.

Operators will use “network access” as leverage to maximize the monetization of their investments. One example is via new kinds of data access (plans) fees and caps; for example, access to LTE or quality of service might cost extra. This may impact developers in different ways, including pushing responsibility to app developers when it comes to data consumption and how to be deal with the consumer. Another example is going after service providers such as Google and other high-data driven services and companies which if they succeed may affect developers as new costs imposed by service providers will be passed down to the developers somehow.

In summary in 2011, we are seeing continuous massive growth on the number of subscribers, and have started to see the move to LTE and 4G, and 4G-like speeds via 3G network updates (which is what T-Mobile has been doing). The role of WiFi on Internet-connectivity from mobile devices is clear. Apps, apps, apps are the new cash-cow for developers and publishers, and operators as well since apps drive data-usage. Operators will look for and invest on new ways to gain visibility into the impact of apps on their networks. Operators will introduce their own app stores and operator APIs, and go-to-market incentives, which together with network access, they will use as leverage, mainly to tackle the issue of lost leverage when the control/power shifted to the ecosystem. But to be determined is how such Operator app stores and APIs will do, from the adoption perspective; they must win the developer first. At the end, network access, the pipe, is the Operator’s true leverage.

ceo